Learn how to beat inflation by investing. Diversify your portfolio with stocks, bonds, real estate, commodities, and inflation hedges to manage risk.

The purchasing power of money decreases over time due to inflation, which is an unavoidable economic phenomenon. Currency depreciation due to rising prices of goods and services lowers people’s standard of living and may lower investment returns in real terms.

If you want to keep more of your money and see it grow over time, you need to invest in things that can potentially outpace inflation. In this article, we list some suggestions for where to put money to beat inflation.

Contents

- What is Inflation?

- What Causes Inflation?

- How To Calculate Inflation Rate

- How Much Interest Does it Take to Beat Inflation?

- How Does Investing Help You Beat Inflation?

- 10 Ways to Beat Inflation by Investing

- #1. Invest in Stocks

- #2. Invest in Real Estate

- #3. Purchase Treasury Inflation-Protected Securities (TIPS)

- #4. Invest in Commodities (Gold & Silver)

- #5. Invest in Dividend-Paying Stocks

- #6. Invest in Inflation-Indexed Annuities

- #7. Invest in High-Yield Bonds

- #8. Invest in Infrastructure

- #9. Invest in REITs

- #10. Build a Diversified Portfolio

- Finance & Investment Tips

What is Inflation?

What does inflation mean? Inflation – meaning the rate at which the general level of prices for goods and services is rising, leading to a decrease in the purchasing power of a currency. Essentially, as inflation rises, every dollar you own buys a smaller percentage of a good or service.

Inflation is typically measured by the Consumer Price Index (CPI) or the Producer Price Index (PPI), which tracks changes in the prices of a basket of goods and services over time.

Central banks typically aim to manage inflation, often targeting an inflation rate to maintain a balance between ensuring the economy remains stable and avoiding deflation (a sustained decrease in the general price level of goods and services).

What Causes Inflation?

How does inflation work? Inflation can be caused by various factors, including:

- Demand-Pull Inflation: This occurs when the demand for goods and services exceeds their supply. When demand outstrips supply, sellers can increase prices, leading to inflation.

- Cost-Push Inflation: This type of inflation happens when the cost of production increases, leading producers to raise prices to maintain their profit margins. Factors such as increased wages, higher raw material prices, or taxes can contribute to cost-push inflation.

- Built-In Inflation: This is also known as wage-price inflation and occurs when workers demand higher wages to keep up with rising prices. When businesses raise prices to cover the higher wages, it can lead to a cycle of increasing wages and prices.

- Monetary Inflation: This occurs when the money supply in an economy grows faster than the economy’s ability to produce goods and services. Central banks can contribute to monetary inflation by printing more money or lowering interest rates.

- Expectations: If people expect prices to rise in the future, they may increase their demand for goods and services now, leading to inflation. Similarly, if workers expect higher wages, they may push for wage increases, which can contribute to inflation.

- External Factors: Events such as natural disasters, political instability, or changes in exchange rates can also lead to inflation by disrupting supply chains or increasing the cost of imports.

- Government Policies: Government policies, such as excessive government spending or a loose monetary policy, can contribute to inflation by increasing the amount of money in circulation.

These factors can work alone or in combination to cause inflation, and the exact causes can vary depending on the economic conditions of a country or region. Inflation can have both positive and negative effects on the economy.

Moderate inflation can stimulate spending and investment as people are incentivized to buy goods and services before prices rise further. However, high or unpredictable inflation can erode purchasing power, reduce the value of savings, and create uncertainty in the economy.

Central banks often aim to keep inflation stable and predictable through a combination of monetary and fiscal policies like interest rate adjustments.

How To Calculate Inflation Rate

To find the current inflation rate, you can use an inflation calculator that uses historical Consumer Price Index (CPI) data from the U.S. to determine the relative value of the U.S. dollar in various years.

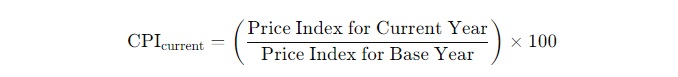

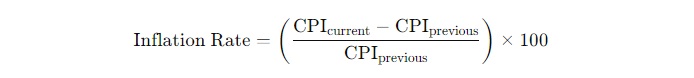

Calculating the inflation rate involves comparing the change in the Consumer Price Index (CPI) over time. Here’s how you can do it:

Select a Base Year:

Choose a base year for comparison. The CPI in the base year is typically set to 100.

Calculate the CPI for the Current Year:

Determine the CPI for the current year using the CPI formula below:

Calculate the Inflation Rate:

Use the CPI values to calculate the inflation rate using the inflation rate formula below:

Where CPI_previous is the CPI from the previous year.

The inflation rate is a key economic indicator that helps policymakers, businesses, and individuals make informed decisions. It is important for several reasons:

- Economic Indicator: It provides insight into the state of the economy. High inflation can indicate an overheated economy, while low inflation can suggest weak demand.

- Monetary Policy: Central banks use the inflation rate to adjust monetary policy. They may raise interest rates to combat high inflation or lower rates to stimulate growth during low inflation.

- Cost of Living: Inflation affects the cost of living, as rising prices reduce the purchasing power of money. Individuals and businesses use the inflation rate to adjust budgets and pricing strategies.

- Investment Decisions: Investors consider the inflation rate when making investment decisions. They may seek investments that outpace inflation to preserve their purchasing power.

- Wage Adjustments: Inflation can influence wage negotiations. Workers may seek higher wages to keep up with rising prices, which can impact businesses’ costs.

How Much Interest Does it Take to Beat Inflation?

To beat inflation, you generally want to earn a rate of return on your investments that is higher than the inflation rate. Inflation rates vary widely, but historically, they have often been around 2% to 3% per year in developed countries. However, recent years have seen higher rates in some places.

To get a real return (after inflation) of 2 to 3%, you might aim for an investment that can provide a return of 4 to 5% or higher. In developing countries like India, you can earn an interest rate of 5% to 7% in a savings account (9% for senior citizens).

This would give you a cushion to cover inflation and grow your purchasing power. Remember that different investments carry different levels of risk and return, so it’s important to consider your risk tolerance and timeline when choosing where to invest.

How Does Investing Help You Beat Inflation?

How does investing beat inflation? Investing allows you to beat inflation and maintain the purchasing power of your money over time.

If you believe that the best way to beat inflation is to save your money in a bank savings account, you’re misinformed. So, why is investing more likely to beat inflation vs. saving in the long term?

Investing is more likely to beat inflation compared to saving in the long term for several reasons:

#1. Higher Potential Returns

Investments such as stocks, bonds, and real estate have historically provided higher returns than the interest rates offered by savings accounts or certificates of deposit (CDs).

These higher returns can exceed the rate of inflation over the long term helping you stay ahead of inflation and grow your wealth over time. You can maintain or increase your purchasing power over time by earning a return on your investment higher than the inflation rate.

#2. Reinvesting Dividends & Interest

Reinvesting the dividends or interest payments you receive from your investments can help accelerate the growth of your portfolio. Over time, compounding returns can help you stay ahead of inflation.

#3. Adjusting for Inflation

Some investments, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to protect against inflation. These investments adjust their principal value based on changes in the Consumer Price Index (CPI), ensuring that your investment keeps pace with inflation.

#4. Compounding Returns

Investing allows you to benefit from compounding returns, where your investment earnings are reinvested to generate additional earnings. Over time, compounding can significantly increase the value of your investment and help you outpace inflation.

#5. Inflation Protection

Certain investments, such as stocks and real estate, have demonstrated the ability to provide a hedge against inflation. These investments can increase in value over time, helping you maintain your purchasing power in inflationary environments.

#6. Long-Term Perspective

Investing is typically done with a long-term perspective, allowing you to ride out short-term market fluctuations and benefit from the growth potential of your investments over time.

This long-term approach is well-suited to beating inflation, which is also a long-term phenomenon. Over the long term, the returns from investing in stocks and other assets have historically outpaced inflation.

#7. Risk vs. Reward

It’s important to note that investing always carries some level of risk, and there are no investments guaranteed to beat inflation. While investing comes with risks, including the potential for loss, it also offers the potential for higher rewards compared to saving.

By carefully managing risk and diversifying your investments, you can potentially achieve higher returns that outpace inflation. Carefully consider your investment goals, risk tolerance, and time horizon before making investment decisions.

#8. Diversification

By diversifying your investments across different asset classes, you can reduce the risk of losing money to inflation. Different types of investments may perform better or worse during periods of inflation, so spreading your investments can help protect your portfolio.

By seeking professional advice from a financial advisor, you can manage risk and improve your chances of beating inflation in the long term.

10 Ways to Beat Inflation by Investing

Which investments offer the hope of outpacing inflation over time? What are some safe investments that beat inflation? Here’s where to invest to beat inflation and build wealth over time.

#1. Invest in Stocks

Those looking to hedge their money against inflation and maybe even outpace it should consider putting their money into well-established, fundamentally sound companies.

Long-term investors looking for growth and wealth preservation should consider the stock market because of its history of outperforming inflation. Investing in stable businesses can pay off in the long run because they can adjust to and even thrive in different economic climates.

These businesses can weather economic storms thanks to their resilient business models, competitive advantages, and seasoned management teams. This allows them to maintain their profit margins and create value for their shareholders even as costs rise.

Furthermore, despite short-term fluctuations and market corrections, the stock market has historically demonstrated a consistent upward trend over extended periods. In an environment where cash and fixed-income investments lose value due to inflation, this innate growth potential becomes even more important.

Investors can take advantage of the compounding effect, where reinvested dividends and capital gains can result in significant wealth accumulation over time, by investing in the stock market.

Investors who hope to outperform inflation will also benefit from dividends. Companies with a long history of success often pay dividends to their shareholders.

Over time, these dividend payments may grow, sometimes at a rate that matches or even outpaces inflation. Therefore, investors receive a reliable source of income that protects their purchasing power, especially during times of rising prices.

However, investors should be aware that the stock market is volatile and that individual companies can experience setbacks. Diversification is crucial for mitigating these dangers. Investors can lessen their reliance on the success of a single stock by diversifying their holdings across a wide range of businesses and industries.

Investors in the stock market need to have a long-term perspective and the patience to ride out the inevitable ups and downs of the market without letting them derail their carefully planned investment strategy.

The stock market’s historical ability to provide capital appreciation, dividend income, and the benefits of long-term compounding makes it possible to outpace inflation by investing in well-established and fundamentally strong companies.

Take a methodical and diversified approach to the stock market, tailoring your holdings to your risk appetite and the scope of your financial goals. By doing so, you can use the stock market to protect yourself from inflation while also accumulating long-term wealth.

Pro Tip: Watch this video with Ray Dalio, founder of the world’s largest hedge fund, who shares his early mistakes, smartest moves, insights on where the market is heading next, and his “holy grail” for optimizing investment portfolios.

In this MasterClass on Mastering the Markets Series with Ray Dalio and three other Wall Street titans, you’ll understand how to make smarter investments, rise above the rest, and navigate the market with insight from investors trusted with more than $150 billion.

Click here to preview this MasterClass

#2. Invest in Real Estate

Historically, real estate investments have been trusted as a safe way to protect wealth from inflation. The unique qualities of real estate assets, such as rental income and property value appreciation, provide several benefits in the face of rising prices.

The rental income that real estate can produce is a major factor in why it is a good inflation hedge. Rental prices typically rise in tandem with inflationary pressures on the cost of living. Investors in real estate can then adjust their rental income to protect their real purchasing power.

Real estate income has the potential to grow over time, aligning with inflation and providing investors with a stable income stream, in contrast to fixed-income investments like bonds, where the income remains fixed.

In addition, over time, the value of real estate tends to rise. Even with temporary dips, the long-term trend in economically healthy and strategically placed areas is up.

Real estate, in particular, has a history of maintaining or appreciating while fiat currencies lose purchasing power due to inflation. This growth in value does double duty by protecting the initial investment and laying the groundwork for future profit from the sale of the property.

In his MasterClass, Robert Reffkin, visionary founder and CEO of Compass, unravels the secrets of the intricate home-buying process, revealing the keys to confident buying and selling, choosing the perfect agent, crafting irresistible offers, and more.

Click here to preview Robert Refkin’s MasterClass

The inherent value and limited real estate supply also make it resistant to inflation. Real estate in desirable areas is in high demand due to population growth and continued urbanization, pushing up prices. This supply and demand gap is a buffer against inflation’s eroding effects.

Real estate investment, like any other type of investment, is not without its risks. But when you diversify your portfolio to include real estate, you’re better able to weather economic storms and protect your purchasing power against inflation.

Due to the prospect of increasing rental income and property value appreciation, real estate investments make a compelling case as a hedge against inflation. A tangible asset that maintains its value despite rising prices can be obtained by investors who choose locations with stable demand and growth potential.

Pro Tip: The success of a real estate investment is highly dependent on market conditions, location, and property management. Spreading your investments across multiple properties and locations can reduce your exposure to risk and increase your profit potential.

#3. Purchase Treasury Inflation-Protected Securities (TIPS)

Those who wish to protect their wealth from inflation should consider purchasing Treasury Inflation-Protected Securities (TIPS). These are U.S. Treasury bonds specifically designed to protect against inflation.

The principal value of TIPS adjusts based on changes in the Consumer Price Index (CPI), ensuring that your investment keeps pace with inflation. As the CPI rises due to inflation, the principal value of TIPS rises as well, protecting investors’ purchasing power.

TIPS offers a double-layered defense against inflation as follows:

- The inflation-adjusted face value of the bond is guaranteed to the bondholder thanks to the periodic adjustment of the principal value. This ensures that the investment will keep its real value over time, regardless of the rate of inflation.

- Like inflation, the interest rates on TIPS increase over time. Interest payments rise in tandem with inflation because a constant rate is applied to the adjusted principal. This guarantees that the purchasing power of interest income is preserved while also providing investors with a higher yield than standard fixed-rate bonds.

TIPS are a safe and stable investment choice for those who would rather avoid taking any chances. Treasury Inflation-Protected Securities (TIPS) are guaranteed by the U.S. government and carry no market or credit risk.

Investors can rest easy knowing their money is safe in these bonds because of how low-risk they are compared to other assets. In addition, investors who are looking for tax-efficient ways to combat inflation will appreciate that TIPS are exempt from state and local income taxes.

Because TIPS come in a range of maturities, investors can select a time frame that best suits their financial objectives and comfort level with risk. They provide a safe and government-backed way for risk-averse investors to avoid losing money to inflation and maintain their standard of living.

Treasury Inflation-Protected Securities (TIPS) are, in sum, a reliable and secure investment option designed specifically to protect against inflation. They offer stability and a known level of protection against inflation, but they may not provide the same level of returns as riskier assets like equities.

Investors’ purchasing power is protected over time thanks to their innovative design, which adjusts principal value and interest payments following changes in the CPI.

Pro Tip: TIPS are an excellent addition to a diversified portfolio, especially when combined with other assets that may have a higher return potential but carry a higher level of risk.

#4. Invest in Commodities (Gold & Silver)

Commodity investments offer an attractive means of protecting wealth and coping with inflation. Gold, silver, oil, and agricultural goods all have their own intrinsic worth and are used by many different types of businesses and people.

These commodities are a powerful inflation hedge because demand for them increases as inflation takes hold, driving up their prices.

Gold and silver are considered “precious metals” and have been used as money for centuries. Investors seek the safety of these metals, driving up their prices, during times of economic uncertainty and inflationary pressures.

In particular, gold has a reputation for being a “crisis commodity,” or an investment that is a safe haven in times of economic or political uncertainty. This makes it a desirable asset for those who wish to hedge their bets against the swings in the value of more conventional investments.

In the courses below, you’ll learn about gold as a distinct asset class, and genuine store of value, and how to invest in gold and silver to diversify your retirement savings and fight economic volatility.

Learn how to invest in gold:

- How To Invest in Gold

- Understand and Acquire Gold & Silver

- Gold & Silver Investing For Retirement

- Investing in Gold & Gold Mining Stocks Course

- Gold Silver Soft Commodity Trading Course

Oil is also an essential global commodity because of its central role in the transportation, manufacturing, and energy sectors.

The price of oil and petroleum products tends to rise because of rising demand as a result of rising living costs. Since oil’s value is directly affected by shifts in the demand and supply of energy, investing in it can be a useful hedge against inflation.

Grain and livestock are two examples of agricultural products that see increased demand in times of inflation. Agricultural commodities are in high demand because of rising populations and shifting eating habits.

Unfavorable weather and supply chain disruptions can also lead to temporary shortages and price increases. Since the rising cost of food and other necessities also drives up the value of agricultural commodities, investing in them can be a hedge against inflation.

Direct ownership, commodity futures contracts, and exchange-traded funds (ETFs) that follow commodity price movements are all viable options for those looking to invest in commodities. Investors need to weigh their investment goals and risk tolerance against the complexity and risks of each method before making a final decision.

One of the best ways to protect one’s wealth and maintain purchasing power during times of inflation is to include commodities as part of a well-diversified investment portfolio.

Gold, silver, oil, and food products are all examples of commodities that offer a promising hedge against inflation. These commodities are a good way to protect your purchasing power from inflation because their prices tend to rise in tandem with the rising cost of living.

#5. Invest in Dividend-Paying Stocks

While stocks carry more risk than bonds, investing in stable, dividend-paying companies can provide a source of income that may outpace inflation over time.

Companies with a track record of dividend payments provide shareholders with a stable and potentially increasing source of income, making them an attractive investment during periods of high inflation.

Shareholders receive dividend payments from their company regularly. Dividends give investors a real return on their money and, because they tend to stay the same, they can help cushion the blow of inflation.

There are several reasons why dividend stocks may be able to generate returns over inflation. To begin, dividend-paying companies tend to be long-standing, financially sound, and profitable.

These features allow them to weather economic storms and continue paying dividends regardless of the state of the economy. Therefore, investors have a reliable source of income that grows over time, giving them peace of mind despite the economy’s volatility.

It’s also worth noting that businesses frequently evaluate and revise their dividend policies. Companies may decide to raise dividends in response to inflationary pressures so that their stock prices remain attractive to investors despite the impact of rising costs.

This means that the purchasing power of the investor’s income is protected against inflation thanks to dividend-paying stocks. In addition, dividend stocks provide a distinctive blend of income and growth potential.

The stock price of a company can rise if the company decides to increase dividend payments or reinvest its growing profits. Investors can expect a substantial total return from this combination of capital appreciation and rising dividend income.

Dividend-paying stocks are a common choice for those looking to preserve capital in a diversified manner. These stocks offer investors a steady stream of income, the possibility of growth in their investment, and the stability that comes from exposure to well-established businesses.

To sum up, dividend-paying stocks provide shareholders with a reliable source of income that has the potential to grow at a rate faster than inflation. Investors can count on a stable source of income that keeps pace with inflation as companies adjust dividends to reflect their profitability and inflationary pressures.

Dividend stocks provide investors with financial security and growth opportunities, and their combination of dividend income and the possibility of capital appreciation makes them an attractive addition to a diversified investment portfolio.

Pro Tip: When choosing dividend-paying stocks, it is crucial to think about things like the company’s financial health, dividend history, and sector performance.

#6. Invest in Inflation-Indexed Annuities

Retirement income can be protected from the eroding effects of inflation with the help of inflation-indexed annuities, also known as cost-of-living-adjustment (COLA) annuities.

The impact of rising prices during retirement can be especially worrisome, as retirees rely on their savings and investments to maintain their standard of living. An inflation-adjusted annuity can help with this problem by guaranteeing a steady stream of money regardless of how much the cost of living goes up or down.

Inflation-adjusted annuities are designed to increase regular payments in line with inflation, as opposed to traditional fixed annuities, which offer a predetermined, fixed income. This means that the retiree’s annuity payments will increase in line with the general increase in prices over time.

Retirees can meet their financial obligations and keep up their standard of living despite rising costs due to inflation without having to reduce their annuity income. Longer retirements, during which inflation can compound and erode the value of fixed payments, highlight the importance of inflation-adjusted annuities.

An annuity that accounts for inflation can help retirees feel more secure about their financial future and give them more peace of mind by reducing the likelihood that their income will fall behind the rising cost of living.

Additionally, annuities that account for inflation provide a reliable and consistent source of income. Because annuity payments are guaranteed to keep pace with inflation, retirees can confidently plan for their financial futures.

During times of economic uncertainty, when market fluctuations and interest rate changes affect other investments, this predictability can be especially valuable. Inflation-adjusted annuities can be a great way to hedge against inflation, but they do not come without potential drawbacks, such as lower initial payout rates compared to fixed annuities.

If you’re concerned about the eroding effects of inflation on your retirement income you can consider purchasing an inflation-adjusted annuity. These annuities help retirees maintain their purchasing power by providing a steady stream of income that rises in tandem with inflation.

Inflation-protected annuities are a great way to improve retirement financial security when used in conjunction with other retirement income sources and a diversified investment strategy.

Pro Tip: Retirees need to compare the terms and conditions of different annuity products, as annuities may have fees and surrender charges.

#7. Invest in High-Yield Bonds

Bonds are a common option for those looking for both reliable income and security for their money.

However, due to their fixed interest rates, they are frequently impacted negatively by inflation, which erodes real returns for investors because it reduces the purchasing power of interest payments from conventional bonds.

Retirees living off a fixed income, or those who are risk-averse and want to safeguard their wealth, may find this particularly worrisome. High-yield bonds, also known as junk bonds, could be an option for investors concerned about the negative impact inflation will have on their bond portfolios.

High-yield bonds are riskier than investment-grade bonds because they are issued by companies with lower credit ratings. Higher interest payments or yields are offered on these bonds to compensate investors for the greater risk.

Because their higher yields have the potential to outpace inflation, high-yield bonds may be beneficial in an inflationary environment. Investors can protect their purchasing power by using the additional income provided by these bonds even though their fixed interest rates are still vulnerable to inflation.

High-yield bonds, with their higher yields, may provide a better opportunity to protect purchasing power as inflation eats away at the value of fixed interest payments on conventional bonds.

However, extreme caution should be exercised when dealing with high-yield bonds. These bonds carry a higher credit risk, and their higher yields reflect that. In times of economic downturn, companies that issue high-yield bonds are especially susceptible to financial difficulties and default risk.

High-yield bonds can be a profitable addition to a diversified portfolio, but even so, caution is warranted. Diversifying a portfolio by including high-yield bonds along with stocks and investment-grade bonds can reduce exposure to individual asset classes and boost returns.

Finally, high-yield bonds can provide higher interest payments that may help counteract the impact of rising prices, while traditional bonds may have difficulty in an inflationary environment.

Investors can protect their purchasing power and reduce the impact of inflation on their fixed-income portfolios thanks to the increased yields. Be wary and do your research because high-yield bonds have greater credit risks and may necessitate a more well-rounded approach in a diversified portfolio.

Pro Tip: Before investing in high-yield bonds, carefully evaluate the credit quality of the issuing companies and perform extensive due diligence.

#8. Invest in Infrastructure

Toll roads, bridges, and renewable energy projects are all examples of infrastructure investments, a unique asset class that provides its own set of benefits, especially in an inflationary environment. These investments frequently include automatic price increases tied to inflation.

Transportation systems, power grids, and communications networks are all dependent on infrastructure assets, which are crucial to a country’s economic growth and development.

Infrastructure investments are dependable sources of income regardless of the state of the economy because demand for these services is typically stable and resilient. The ability of infrastructure investments to generate income is a major perk in terms of their effectiveness as a hedge against inflation.

Contractual agreements with governments or public authorities often allow periodic fee adjustments for infrastructure projects like toll roads and bridges to account for inflation.

Infrastructure assets can keep their cash flows in real terms thanks to these built-in price escalation clauses, giving investors a steady income stream that grows with rising prices.

Inflation adjustments are also built into long-term power purchase agreements (PPAs) in certain infrastructure sectors, such as renewable energy projects. Revenue from these projects rises in tandem with inflation, shielding investors from the eroding effects of inflation on investment returns.

In addition, the asset lifespans of infrastructure investments are frequently several decades. Infrastructure assets can last for a long time and continue to function reliably, so their long-term nature is in line with reduced inflation risk.

As a result, long-term investments typically provide steadier returns to their backers. Investments in infrastructure can provide portfolio diversification benefits in addition to protecting against inflation.

The performance of infrastructure assets may not be significantly impacted by fluctuations in the broader financial markets because of their low correlation with traditional equity and fixed-income investments.

The revenue-adjusting mechanisms and cash-flow stability of infrastructure investments make them an attractive option as an inflation hedge. These investments can help the economy grow and provide steady returns that keep up with inflation.

When included in a diversified portfolio, investments in infrastructure can help investors weather the effects of inflation while still realizing their goals of long-term growth and income.

Pro Tip: Examine the infrastructure projects and companies thoroughly from a financial and performance standpoint as infrastructure investments come with their own unique set of risks that must be taken into account before you make any decisions.

#9. Invest in REITs

Companies that own, manage, or provide financing for real estate that generates income are known as Real Estate Investment Trusts (REITs). Equity real estate investment trusts (REITs) provide investors with exposure to real estate appreciation and rental income, both of which have a positive correlation with inflation.

They provide a novel and simple way for investors to take part in the real estate market without having to acquire actual properties. These businesses have a vested interest in real estate assets that generate income, such as office buildings, shopping centers, apartment complexes, and manufacturing plants.

Equity real estate investment trusts (REITs) can be a good way to diversify your portfolio, especially if you’re concerned about inflation. The possibility of real estate appreciation is a major draw for investors in equity REITs.

In general, real estate values rise in tandem with inflationary increases in the cost of living. As a result, investors in REITs stand to gain from any appreciation in the value of the properties they own. The portfolios of some REITs are further bolstered by their involvement in property development and redevelopment.

Rental income from equity REITs’ properties also provides investors with a steady source of income. Inflation generally increases rental income, so REITs can raise lease rates to match rising costs. Equity REIT investors can enjoy a reliable source of income that will not depreciate over time.

Another perk for investors is the diversification provided by equity REITs. Many REITs have holdings in a variety of industries and locations. By investing in multiple properties, risk is spread out and the performance of any one property has less of an effect on the portfolio as a whole.

In addition, real estate investment trusts must pay out a sizeable portion of their profits to shareholders in the form of dividends. As a result, equity REITs can offer attractive dividend yields to their investors, especially when compared to other fixed-income investments that may not keep up with inflation.

However, investors should be aware that REITs carry risks similar to those of any other type of investment. Equity real estate investment trusts (REITs) can be affected by economic downturns, shifts in real estate market conditions, and interest rate fluctuations.

Finally, equity REITs provide investors with exposure to real estate appreciation and rental income that, on average, grow faster than prices due to inflation.

These businesses facilitate entry into the real estate market and add diversification to an investor’s portfolio. However, before making investment decisions involving equity REITs, prospective investors should do extensive research and consider their risk tolerance.

Pro Tip: Research the REITs, their underlying properties, and the financial health of the company thoroughly before making any commitments.

#10. Build a Diversified Portfolio

As the saying goes, “Don’t put all your eggs in one basket,” or risk all you have on the success or failure of one thing.

“Don’t put all your eggs in one basket.”

Building a diversified portfolio is a core tactic used by investors to minimize loss and maximize gain. You can spread your risk and make sure you have exposure to assets that can grow at a faster rate than inflation by constructing a diversified investment portfolio.

Spreading risk and maximizing returns both depend on proper asset allocation. To lessen the effect of any one investment’s performance on the portfolio as a whole, investors often diversify their holdings across multiple asset classes, industries, and geographical regions.

If investors want to have a chance to outpace inflation, they need to make sure they have exposure to assets that can do so. Stocks, bonds, real estate, commodities, and other inflation-hedging assets are common components of a well-diversified portfolio.

Here are some more options to consider as part of a diversified portfolio to beat inflation:

- Series I Savings Bonds: Similar to TIPS, Series I Savings Bonds are also indexed to inflation. They offer a fixed rate of return plus an additional variable rate that adjusts semi-annually based on changes in the CPI.

- High-Yield Savings Accounts: While not guaranteed to beat inflation, high-yield savings accounts typically offer better interest rates than traditional savings accounts, providing some protection against inflation erosion.

- Certificates of Deposit (CDs): CDs with terms that match or exceed the expected duration of inflationary periods can be used to lock in a fixed interest rate, potentially outpacing inflation.

- Short-Term Municipal Bonds: Municipal bonds issued by local governments can provide tax-free income and may offer yields that outpace inflation, especially when held to maturity.

The performance of one asset class may not be directly correlated with that of another, depending on the state of the economy. In times of economic or market volatility, diversification among these assets can help investors weather the storm.

For instance, stocks have greater growth potential and, over time, can produce returns that exceed inflation. However, they tend to be more unstable. Bonds, on the other hand, are safe and pay interest, but they may not keep pace with inflation.

It is crucial to allocate one’s assets strategically, taking into account one’s risk tolerance, investment objectives, and time horizon. Although real estate and commodities can be useful inflation hedges, they are not risk-free investments and have their own peculiar market dynamics.

Since they have more time to ride out market fluctuations, younger investors with longer time horizons may choose to allocate a larger portion of their portfolio to growth-oriented assets like stocks.

Income-generating assets, such as bonds and dividend-paying stocks, may be preferred by retirees and risk-averse investors who seek a more conservative allocation.

To reduce your exposure to risk while still trying to keep up with inflation, constructing a diversified investment portfolio made up of different types of assets is a good way to go.

In this strategy, asset allocation plays a central role by enabling investors to mitigate risk and maximize return following their circumstances and objectives.

Investors can weather economic storms, protect their wealth, and pursue their long-term goals with the help of a diversified portfolio that is carefully planned and closely monitored.

To keep your portfolio well-diversified, asset allocation should be rebalanced regularly. Asset returns can deviate from their original allocation percentages as market conditions change.

To rebalance a portfolio, sell some holdings and put the proceeds towards buying others that are under-represented. This ensures that the portfolio continues to reflect your risk tolerance and return expectations.

Pro Tip: In this MasterClass on Mastering the Markets Series with Ray Dalio and three other Wall Street titans, you’ll learn about long-term growth, risk assessment, and more to take smart risks and build a diversified portfolio.

Click here to preview this MasterClass

Since inflation can eat away at purchasing power over time, investors must pick strategies that can outpace or keep up with inflation. These tips to beat inflation explain which investments beat inflation and why.

Investments in stocks, real estate, inflation-protected securities, commodities, and other inflation-hedging assets can help protect your wealth and maintain your purchasing power. Still, no investment is completely immune to inflationary pressures.

Long-term financial security can be achieved through both frugal living and wise investing. Learning how to leverage frugal living to beat inflation, save money, and achieve economic stability and freedom is important.

Before deciding what to invest in to beat inflation, consider your risk tolerance and long-term financial objectives carefully. Meeting with a financial advisor can help you create a plan tailored to your unique circumstances and needs, increasing your chances of success in the long run despite the effects of inflation.

Disclaimer:

This article contains some machine-written sections. The views and recommendations presented on this website are those of the authors alone.

Never use them without evaluating your personal and financial situation or consulting a professional investment advisor, as they are not and should not be construed as professional financial investment advice.

Like all investments, real estate is highly risky and subject to market fluctuations. Please research before taking any of these steps, as we cannot and do not guarantee that following our advice will result in positive outcomes.

Click here to preview Paul Krugman’s MasterClass

Finance & Investment Tips

- Expert MasterClass on Crypto & The Blockchain

- Robert Reffkin MasterClass on Buying & Selling Real Estate

- Mastering The Markets Series with Ray Dalio & Wall Street Titans

- Paul Krugman MasterClass on Economics and Society

- What Are Safe-Haven Assets and How to Invest in Them?

- Personal Finance for Freelancers and Solopreneurs

- Creative Investments to Diversify Your Portfolio

- How to Leverage Frugal Living to Beat Inflation

- Learn All About NFTs and the Metaverse for Creators

- Free Abundance Courses to Manifest Monetary Abundance

- Best Recession-Proof Businesses To Start In An Economic Downturn

- How To Attract Money: 8 Law of Attraction Money Manifestation Tips

© 2024, Priya Florence Shah. All rights reserved.

Priya Florence Shah is a bestselling author and an award-winning blogger. Check out Devi2Diva, her book on emotional self-care for women. In her spare time, Priya writes science-fiction novels and poetry and chills with her two-legged and four-legged kids.

Discover more from Business & Branding Tips

Subscribe to get the latest posts sent to your email.