Explore creative investment strategies to diversify your portfolio with creative assets and collectibles to unlock new investment opportunities.

In the ever-evolving landscape of investments, creative products are gaining attention as alternative assets that offer a unique blend of aesthetic value and potential financial returns.

Investors are increasingly exploring opportunities beyond traditional avenues like stocks and bonds and safe-haven assets like gold, turning their attention to a diverse range of creative products and collectibles that have the potential to appreciate over time.

Creative investments, encompassing a variety of unique and aesthetically appealing products, present an avenue for diversification. These assets offer a different risk and return profile than traditional financial instruments.

Investing in creative products can be both unique and enjoyable, but it’s essential to approach it with a clear understanding of the associated risks.

Contents

11 Creative Investments & Collectibles to Invest In

Investors seeking to diversify their portfolios often look beyond conventional options. Here are some creative products and collectibles that some investors and collectors might consider as potential investments:

#1. Limited-Edition Art Prints

The art market has long been synonymous with exclusivity and high-value transactions.

While original masterpieces by renowned artists may be beyond the financial reach of many investors, a fascinating avenue within the art world presents itself through limited edition art prints—a market that combines artistic appreciation with the potential for solid financial returns.

Take, for instance, the work of Banksy, the elusive street artist whose limited-edition prints have become coveted by collectors worldwide. Banksy’s “Girl with a Balloon” is a prime example.

The image was created as a mural on a London wall and later released as a limited edition print. Despite the initial limited availability, the print has seen a substantial increase in value over the years, becoming a symbol of the intersection between street art and fine art.

Another notable success story lies in the limited edition prints of renowned contemporary artist Yayoi Kusama. The Japanese artist’s signature polka dots and vibrant patterns, showcased in prints like “Infinity Nets,” have captivated art enthusiasts and proven to be sound investments.

The scarcity of these prints, coupled with Kusama’s global influence, has contributed to their appreciation in value within the art market. The journey of limited edition prints as investments is not confined to contemporary art alone.

Consider the works of iconic 20th-century artists like Andy Warhol. His silk-screen prints, such as the famous “Campbell’s Soup Cans,” have become valuable collectors’ items.

The limited edition art print market can be a rewarding venture for investors who appreciate the blend of artistic brilliance and investment potential.

The limited nature of these prints and their association with the pop art movement has made them sought-after additions to art portfolios.

#2. Limited-Edition Photography Prints

Photography, as an art form, has the power to freeze moments in time and tell compelling stories.

Limited edition photography prints by renowned photographers provide investors with a more accessible entry point into the art market. These prints encapsulate the essence of visual storytelling while offering a tangible investment opportunity.

Consider the work of iconic photographers like Ansel Adams or Dorothea Lange. Limited editions of their prints, featuring breathtaking landscapes or powerful portraits can appreciate in value over time.

Adams’s “Moonrise, Hernandez, New Mexico” is a prime example of a photograph that has not only stood the test of time artistically but has also increased significantly in value as a limited-edition print.

Photography prints allow investors to connect with the emotions and narratives captured in each frame, making them not only aesthetically pleasing investments but also windows into the visual history of our world.

Investors have also found success in the photography print market. Limited edition prints by photographers like Ansel Adams, renowned for his landscape photography, have demonstrated the potential for appreciation over time.

In essence, limited edition art and photography prints offer a bridge between the exclusivity of original artworks and the accessibility desired by a broader investor base.

These prints not only encapsulate the essence of the artist’s or photographer’s vision but also serve as tangible pieces of a limited and coveted collection.

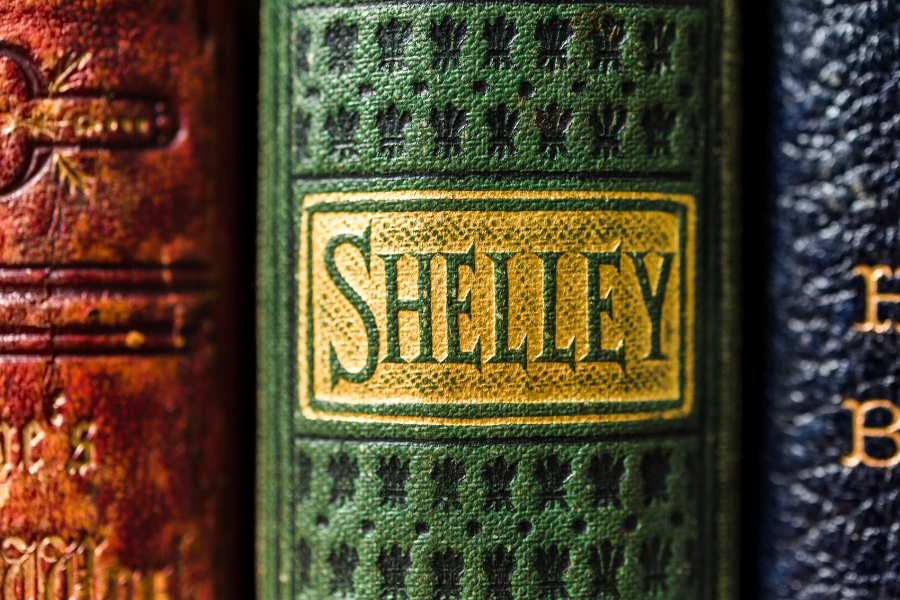

#3. Rare Books & First Editions

Within the realm of creative investments, rare books stand as a captivating and intellectually enriching avenue.

While the original manuscripts of literary masterpieces may reside in museums or private collections, the market for first editions and historically significant editions, particularly those bearing the author’s signature, has become a fascinating intersection of literary appreciation and potential financial gain.

Consider the timeless works of J.K. Rowling, particularly the first edition of “Harry Potter and the Philosopher’s Stone.” As the debut novel of the immensely popular series, the first edition has become a sought-after collector’s item.

Its rarity, coupled with the global phenomenon that is the Harry Potter franchise, has contributed to the increased value of this edition over time.

For investors with a keen eye on literary treasures, this first edition encapsulates not just the magic of Rowling’s narrative but also the potential for financial appreciation.

Another compelling example lies in the world of classic literature, where the value of first editions can soar. Take F. Scott Fitzgerald’s “The Great Gatsby,” a cornerstone of American literature.

First editions of this iconic novel, especially those in excellent condition, are highly coveted by collectors. The scarcity of such editions and their enduring literary significance make them prized assets for investors who appreciate the timeless allure of classic literature.

The allure of rare books extends beyond fiction into historical and philosophical realms. Consider the works of influential figures like Albert Einstein or Charles Darwin.

First editions of their groundbreaking works, when coupled with their autographs or annotations, can become invaluable artifacts.

This niche market, attracting both bibliophiles and investors, intertwines the intellectual joy of reading with the potential for acquiring historically significant and financially rewarding editions.

The success stories in the rare book market underscore the enduring appeal of the written word. For investors seeking to diversify their portfolios with assets that carry cultural and historical weight, rare books provide a unique avenue.

As demonstrated by the appreciation of the value of first editions and author-signed editions from literary giants, rare books emerge not only as collectibles but also as tangible links to the intellectual legacy of human civilization.

#4. Designer Fashion

The world of designer fashion goes beyond trends; it encapsulates a blend of artistic expression and wearable craftsmanship. Limited edition or vintage pieces from iconic designers, such as Chanel, Hermes, or Yves Saint Laurent, transcend mere clothing.

These items become wearable art, carrying the signature styles of fashion legends. Investors with an eye for the unique and timeless appreciate the potential value of these pieces, as they tap into the legacy and enduring appeal of fashion icons.

Consider the case of the iconic Hermès Birkin bag, a symbol of luxury and exclusivity. Limited editions and rare color combinations of this handcrafted masterpiece have seen their market value soar over the years.

Fashion enthusiasts and investors alike recognize the allure of owning a piece of fashion history, making these designer items not just accessories but also tangible investments.

#5. Vintage Vinyl Records

Vintage vinyl records represent a nostalgic journey through the eras of music. Limited edition releases or records from legendary musicians like The Beatles, Elvis Presley, or Bob Dylan become more than just audio recordings—they transform into cultural artifacts.

The resurgence of interest in vinyl has contributed to the appreciation of these tangible pieces of musical history. Investors who understand the intersection of music, culture, and nostalgia find value in building collections of rare and well-preserved vinyl records.

For instance, the demand for original pressings of classic albums like Pink Floyd’s “The Dark Side of the Moon” or The Rolling Stones’ “Sticky Fingers” has led to these records becoming sought-after items among collectors.

The inherent scarcity of pristine vintage vinyl adds to their investment appeal, creating a market where the value of these records can appreciate over time.

#6. Classic Cars

Classic cars evoke a sense of timeless elegance and craftsmanship, making them not just modes of transportation but also tangible expressions of automotive art. Well-preserved classic cars from iconic eras, such as vintage Ferraris, Porsche 911s, or Ford Mustangs, become coveted by collectors and investors alike.

The limited production, historical significance, and enduring design of these automobiles contribute to their appeal as investments. Consider the appreciation in the value of a meticulously maintained 1967 Ford Mustang Shelby GT500 or a classic 1961 Ferrari 250 GT California.

These vehicles, beyond their mechanical prowess, represent cultural milestones and automotive heritage. Investors with a passion for classic cars recognize the potential for substantial returns as the market for these automotive icons continues to thrive.

Vintage cars are not just commodities—they are investments that tap into the essence of cultural nostalgia, making them appealing to both collectors and investors seeking assets that transcend the ordinary and carry a piece of history with them.

#7. Sculptures

Sculptures, as three-dimensional art forms, present investors with a distinctive opportunity to acquire tangible expressions of artistic creativity. Beyond their aesthetic value, sculptures often hold cultural and historical significance.

Limited editions of iconic sculptures by renowned artists, such as Auguste Rodin’s “The Thinker” or Henry Moore’s abstract works, have demonstrated the potential for appreciation over time.

Consider the journey of a contemporary sculptor like Jeff Koons, known for his whimsical and larger-than-life creations. Limited editions of Koons’s sculptures, such as “Balloon Dog,” have become sought-after pieces in the art market.

The physicality and enduring nature of sculptures contribute to their appeal as investments, making them not just decorative elements but also tangible assets with the potential for long-term value appreciation.

#8. Comic Books

The comic book market has evolved from a niche hobby to a thriving industry, with certain issues becoming valuable collector’s items.

Comic books featuring the first appearances of iconic characters, such as Superman’s debut in “Action Comics #1” or Spider-Man’s introduction in “Amazing Fantasy #15,” have become coveted by collectors and investors alike.

The allure of comic book investments lies in the cultural impact of these characters and the scarcity of early editions in good condition. The rise of comic book-based movies and TV shows has further heightened interest in these collectibles.

Investors who recognize the enduring popularity of superheroes and their cultural significance find value in acquiring and preserving these pieces of comic book history.

#9. Antique Furniture

Antique furniture stands at the intersection of history and aesthetic charm, making it a noteworthy area for creative investments.

Pieces from iconic periods or crafted by renowned designers can become valuable additions to an investor’s portfolio. Antique furniture not only carries historical significance but also embodies the craftsmanship and design principles of its era.

Consider the appreciation in the value of a well-preserved Louis XV commode or a mid-century modern Eames lounge chair. These pieces, beyond their utilitarian function, serve as tangible links to different periods of design and cultural history.

Investors with an appreciation for the uniqueness and enduring appeal of antique furniture recognize the potential for these items to appreciate as they age, making them not just functional assets but also cultural artifacts with investment value.

Beyond their aesthetic appeal, these tangible assets offer investors the opportunity to engage with cultural history and artistic creativity and provide a canvas to blend artistry with financial potential.

#10. Artisanal & Handmade Crafts

The expansive realm of creative investments transcends conventional art forms, opening doors to diverse opportunities that blend accessibility with cultural value.

Handmade crafts and artisanal products, each offering a unique avenue for investment, invite investors to engage with visual art in distinctive and culturally significant ways.

The world of handmade crafts and artisanal products is a rich tapestry of uniqueness and cultural expression. Items crafted by skilled artisans, whether it’s handmade textiles, ceramics, or jewelry, carry a cultural value that resonates with investors seeking distinctive and meaningful assets.

Investors often find appeal in handmade crafts not only for their artistic qualities but also for the stories embedded in each creation. Supporting artisans and their traditional craft techniques adds a layer of cultural sustainability to these investments.

As appreciation grows for handmade and artisanal products, their scarcity and cultural significance contribute to their potential for long-term returns. Consider investing in handwoven textiles from indigenous communities or artisan-made ceramics that showcase traditional craftsmanship.

These items become more than just decorative assets; they become tangible connections to cultural heritage and craftsmanship, offering investors the opportunity to support and preserve artisanal traditions.

In conclusion, the realm of creative investments extends far beyond traditional art forms. Handmade crafts provide accessible and culturally rich avenues for investors to diversify their portfolios.

These investments not only offer the potential for financial returns but also allow investors to engage with the visual arts in ways that capture the essence of storytelling, uniqueness, and cultural heritage.

#11. Stamp & Coin Collections

Stamp and coin collections can be considered investments, but their attractiveness as an investment depends on various factors, including market trends, rarity, condition, and individual preferences.

It’s important to note that the market for collectibles can be unpredictable, and success stories are not guaranteed. Here are a few examples where stamp and coin collections have shown appreciation in value:

- The British Guiana 1c Magenta Stamp

Often referred to as the “Mona Lisa of stamps,” the British Guiana 1c Magenta is one of the rarest stamps in the world.

In 2014, it was sold at auction for nearly $9.5 million, making it the most valuable stamp ever sold. Its rarity, historical significance, and the allure of being a one-of-a-kind item contributed to its high market value.

- The Inverted Jenny Stamp

The Inverted Jenny is a U.S. postage stamp with an airplane image accidentally printed upside down. In 2016, a single Inverted Jenny stamp was sold for over $1.35 million.

This stamp’s value is driven by its rarity, as only a small number of misprinted stamps were released.

- The 1933 Double Eagle Gold Coin

The 1933 Double Eagle is a $20 gold coin that gained notoriety due to a legal dispute surrounding its ownership.

In 2002, one of these coins was auctioned for over $7.5 million. The rarity of the coin, along with its historical significance and legal battles, contributed to its high market value.

- The Treskilling Yellow Stamp

The Treskilling Yellow is a Swedish postage stamp that was mistakenly printed with a yellow color instead of the intended green.

In 1996, a Treskilling Yellow stamp was sold at auction for over $2.2 million. The rarity and uniqueness of this printing error made it highly sought after by collectors.

- The Brasher Doubloon

The Brasher Doubloon is one of the first gold coins struck in the United States. In 2011, a rare example known as the “Ephrata Brasher Doubloon” was sold for over $7.4 million.

The historical significance, rarity, and the coin’s connection to early American numismatics contributed to its high market value.

While these examples showcase the potential for appreciation in the value of stamps and coins, it’s important to recognize that not all collections will yield such substantial returns.

Successful investments often involve a combination of factors, including rarity, historical significance, condition, and collector demand.

Additionally, market conditions and trends can change, impacting the value of collectibles over time. As with any investment, thorough research and careful consideration are essential.

How To Invest in Collectibles & Creative Assets

Investing in creative assets such as limited edition photography prints, handmade crafts, artisanal products, stamps, and coin collections involves a combination of research, passion, and a strategic approach.

Here are some steps to consider when venturing into cultural artifacts and collectibles as creative investments:

#1. Educate Yourself

Learn about the specific market for each type of creative investment (photography prints, handmade crafts, etc.). Understand the factors that influence the value of these assets, such as the reputation of artists or artisans, historical significance, and market trends.

Identify photographers, artists, or artisans whose work you admire and believe has investment potential. Consider their reputation, exhibition history, and market demand for their creations.

Attend art shows, galleries, and museum exhibitions to get a firsthand look at potential investments. Engage with the art community, meet artists or artisans, and network with other collectors and investors.

#2. Get Authentication & Documentation

Authenticity is crucial in the world of collectibles. Ensure that the items in the collection are genuine and properly documented. Third-party authentication services can provide credibility and add value to the collection.

Understand the concept of limited editions and the impact of scarcity on value. Ensure that the prints or handmade items you’re considering come with proper documentation of authenticity.

Rare collectibles and artifacts, especially those with limited production or historical significance, tend to have a higher potential for value appreciation. Items that are scarce and in demand among collectors are generally more likely to see increases in value over time.

#3. Consider Historical & Cultural Significance

Collectibles that have historical importance or commemorate significant events may have greater appeal to collectors and investors. Items tied to notable figures, cultural milestones, or important periods in history often attract more attention in the market.

For handmade crafts and artisanal products, consider the cultural significance and heritage associated with the items. Understand the materials, craftsmanship techniques, and the story behind each piece.

#4. Stay Informed About Collectors’ Trends

Remember that the value of creative products as investments can be subjective and influenced by trends, demand, and the overall market for these items. Like any investment, the market for art and collectibles can fluctuate.

Understanding cultural trends is essential in the world of creative investments. Economic conditions, collector trends, and geopolitical factors can all influence the value of these items.

The market dynamics for these assets can be influenced by shifts in tastes, societal trends, and the popularity of particular artists or designers. Staying attuned to these cultural nuances is crucial for investors looking to navigate the creative investment landscape effectively.

Keep abreast of market trends, emerging artists, and shifts in consumer preferences. Subscribe to art magazines, follow relevant blogs, and participate in forums to stay informed.

#5. Network with Experts & Professionals

Professional guidance can help you navigate the complexities of the art market and make informed decisions. Attend industry events and seminars to broaden your understanding of the market.

If needed, seek advice from financial advisors, art consultants, gallery owners, or experts in the field who can provide insights and guidance who specialize in creative investments.

Their insights can provide valuable guidance on market trends, potential investments, and the overall health of the collecting community.

#6. Store & Insure Your Collectibles

The condition of the collectibles significantly impacts their value. Well-preserved items with minimal wear and tear are typically more desirable to collectors.

Proper storage and maintenance are crucial to preserve the quality of the collection. Any damage or deterioration can affect its market value.

Establish a budget for your creative investments, taking into account both acquisition costs and potential long-term holding expenses. Be mindful of additional costs such as framing, conservation, or insurance.

Ensure proper storage conditions to preserve the quality of your creative investments. Obtain adequate insurance coverage to protect against potential risks such as theft, damage, or loss.

#7. Diversify Your Portfolio

Consider diversifying your creative investments across different artists, mediums, or styles to spread risk. Explore a mix of established and emerging artists or artisans.

Diversifying your collection by including items from different periods, regions, or themes can reduce risk and enhance the overall appeal to a broader range of collectors.

#8. Have Passion & Long-Term Perspective

Investments in collectibles are often considered long-term and enjoying the hobby can be a significant aspect of the overall investment experience.

Investing in creative products requires a genuine passion for the specific type of art or collectible, as well as a long-term perspective, a well-researched and strategic investment plan, and a willingness to hold onto the investment for the long term.

While the potential for financial gain is a consideration, collectors often derive satisfaction from their passion for collectibles. Values may appreciate over years or even generations, rather than months, so patience is key for investors in this niche.

Conclusion

Collectibles can be viable investments, but success in this area requires careful research, an understanding of market dynamics, and a genuine interest in the hobby. While potential financial gains are possible, collectors should also find intrinsic value in the items they acquire.

So clarify your investment objectives, whether they are primarily financial, cultural, or a combination of both. Determine your risk tolerance and the level of involvement you want in managing your creative investments.

Investing in creative assets can be both rewarding and nuanced. Venturing into creative investments offers a dynamic and diverse approach to portfolio management.

By embracing the world of creative products, investors can add a touch of uniqueness to their portfolios while potentially reaping the rewards of appreciation over time.

Financial Disclaimer:

The information provided in this article should not be considered personalized financial advice. Before making any investment decisions, consult with a qualified financial advisor who can provide tailored guidance based on your individual financial situation, goals, and risk tolerance.

Additionally, conducting comprehensive research and due diligence on specific investment opportunities is essential to make informed and prudent financial choices.

Investing always carries inherent risks, and it is imperative to seek professional guidance and conduct your own analysis before committing to any financial strategy or asset allocation.

Finance & Investment Tips

- Expert MasterClass on Crypto & The Blockchain

- Robert Reffkin MasterClass on Buying & Selling Real Estate

- Mastering The Markets Series with Ray Dalio & Wall Street Titans

- What Are Safe-Haven Assets? How to Invest in Them?

- How to Beat Inflation by Investing

- Learn All About NFTs & the Metaverse for Creators

- Free Abundance Courses to Manifest Monetary Abundance

- Best Recession-Proof Businesses To Start In An Economic Downturn

- How To Attract Money: Law of Attraction Money Manifestation Tips

© 2023 – 2024, Priya Florence Shah. All rights reserved.

Priya Florence Shah is a bestselling author and an award-winning blogger. Check out Devi2Diva, her book on emotional self-care for women. In her spare time, Priya writes science-fiction novels and poetry and chills with her two-legged and four-legged kids.

Discover more from Business & Branding Tips

Subscribe to get the latest posts sent to your email.